Watches are an important part of our lives because they keep us aware of the time and not only this, but they have many additional features as well. In addition to that, a good watch can add a lot to the style statement of the person who wears. This is the reason why nowadays people concentrate a lot on design and features.

With the advent of smartwatches, most of the users have switched to them and the incredible features of the sports watches are overlooked by those expensive watches.

Why it’s good to buy a sports watch?

Here we will discuss why you should buy a sports watch.

RUGGED DESIGN WILL GIVE AMAZING LOOK:

The first thing that anyone will notice in their sports watch will be the rugged design. This means that not only the outlook of the watch will be very aggressive, but it will provide a lot of strength to these watches as well. With a lot of strength, you must find no problems when using these watches in any type of environment.

The aggressive design of the watch will also provide you the extra motivation that you will need during heavy workout routines.

INCREDIBLE BATTERY LIFE WILL MAKE LIFE EASY FOR YOU:

One of the things that is missed in most of the modern-day watches is the battery life. This is not the case with the sports watches and these watches are designed to provide performance. When you get the sports watch, you will be amazed by the incredible life that its battery provides.

Unlike some of the common watches, the sports watch will not require a battery replacement for a lot of time, and they will be with you every day.

NO WORRIES REGARDING OUTDOOR USAGE:

This is another great feature that is only present in the sports watches.

· Most of the modern watches that we can buy right now can provide water resistance, but it is only up to a certain extent.

· Additionally, these modern watches are not designed to be used in harsh weather conditions. This makes taking them everywhere almost impossible.

It is because of the fear of damaging them. In this case, the sports watches are designed against standards that allow these watches to be used everywhere even in the harsh weather conditions and there will be no problems in using them.

NECESSARY FEATURES AVAILABLE AT THE PRESS OF A BUTTON:

Apart from checking date and time, one very important feature that people use is the stopwatch. Although this is present in most of the watches, it is not very easily accessible there. But with the sports watch, you will never need to worry to scroll through different menus just to get to simple things like a stopwatch.

The best thing about having a sports watch is that it has dedicated buttons for features like these so that it can save your time.

LATEST TECHNOLOGIES WITH MULTIPURPOSE FEATURES:

If you want to use your sports watch as a multipurpose watch that will serve for its fitness features and utility benefits as well, then buying the sports watch will be the best thing for you. This is because, with the help of the latest technologies, we are now able to implement a lot of things simultaneously in a watch.

This makes the watches very practical as now they are serving a lot of additional useful features.

Our top 5 recommendations for buying a sports watch:

If you are looking to get a sports watch with an amazing blend of style, features, and quality then here we have our top 5 recommendations that you can buy.

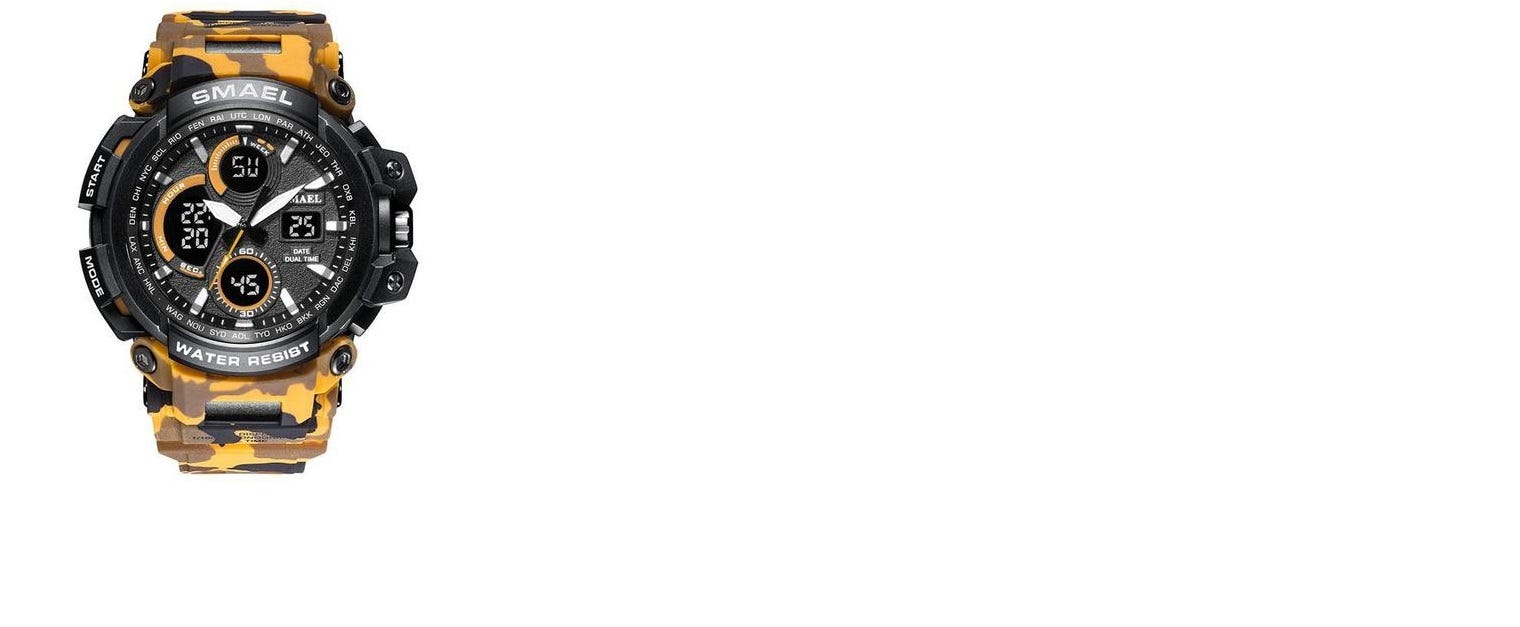

Military-style multifunction sports watch

If you want to get a watch that has a lot of features on the screen and still manages to maintain a decent style to the outlook, then this is the right watch for you. This watch features a dual time setting option where one clock is digital, and one is analog. Other than this, the watch comes in a very aggressive design and an eye-catching large dial.

Features.

Some features of this watch are listed below.

· LED display with backlight.

· Shock-resistant durable design.

· Alarm and sound features for different things.

Military-style digital sports watch

This is the watch that offers a digital dial with a black LED display. On this watch, there is no analog clock system, and the watch packs all the necessary features of a sports watch. The watch also shows day, date, month, and time zone format. The rubber band and durable plastic dial provides this watch a very premium and durable feel.

Features.

Some unique features of this watch are mentioned below.

· Seamless design.

· Huge digital display.

· Time zone format is shown.

LED sports watch with leather band

If your need for the watch requires you to have a watch that can not only be used as a smartwatch, but you can also use it as your daily wearing watch, then this will be one of the best options for you. This watch offers a great stylish dial with a dual clock. The leather band of this watch adds to the style and comfort of wearing this watch.

Features.

The following are the features of this watch.

· Unique style with hidden digital watch.

· Metallic rim provides an aggressive feel.

This watch has a 50mm large dial that is more than enough for your sport’s needs. On the display, this watch has an LED color display that provides all the necessary information.

Features.

Some features of this watch are.

· Backlight luminous grey color display.

· Shock-resistant body.

This is the watch that can divide you all the necessary features of a sports watch, but its attractive thing is that it has a lot more to offer. Other than the features, the design of this watch and the price is also very attractive.

Features.

The following are the features of this watch.

· Compatible with the latest devices.

· Full touch screen style.

FINAL THOUGHTS:

If you are looking for a sports watch but you are confused if you should buy one or not, you can get the general ideas from our reasons for buying a sports watch and how important it is to have sports. Here we also recommended some unique and amazing sports watches.